In previous post (Read Here), i explained about "SBI DEBIT CARD FRAUDULENT TRANSACTIONS COMPLAINT PROCEDURE".

But in recent times, the fraudulent transactions are in increasing pace. Most of us are being made victims on different platforms through various websites. After this, we are in dilemma where we have to escalate this issue to resolve our problem. Here we are providing some email address to complain your fraudulent transactions immediately.

But in recent times, the fraudulent transactions are in increasing pace. Most of us are being made victims on different platforms through various websites. After this, we are in dilemma where we have to escalate this issue to resolve our problem. Here we are providing some email address to complain your fraudulent transactions immediately. | MERCHANT | E MAIL |

| PAYTM | cybercell@paytm.com |

| support@one97.com | |

| info@one97.com | |

| security@paytm.com | |

| BILL DESK | genius@billdesk.com |

| support@bildesk.com | |

| pgsupport@bildesk.com | |

| CCAVENUES | risk@ccavenue.com |

| service@ccavenue.com | |

| PAYU | reportfraud@payu.in |

| OXIGEN | fraud.control@myoxigen.com |

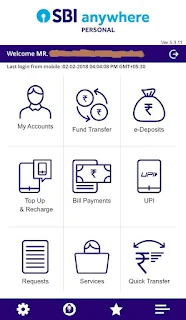

| SBI Apps | alert.buddy@sbi.co.in |

| sbiepay@sbi.co.in | |

| opshead.sbiepay@sbi.co.in | |

| rfc.sbiepay@sbi.co.in | |

| contactcentre@sbi.co.in | |

| agmcustomer.|hoand@sbi.co.in | |

| MOBIKWIK | risk@mobikwik.com |

| Nodal@Mobikwik.com | |

| fraudalerts@mobikwik.com | |

| VODAFONE MPESA | leasupport.mpesa@vodafone.com |

| ICIC| POCKET WALLET | ajinkya.duragkar@icicibank.com |

| karthik.junnuri@icicibank.com | |

| headservicequality@icicibank.com | |

| pockets@icicibank.com | |

| IDEA MONEY | manish.srivastava4@idea.adityabirla.com |

| AIRTEL MONEY | wecare@airtelmoney.com |

| ATOM | rcu@atomtech.in |

| helpdesk@atomtech.in | |

| operations@atomtech.in | |

| CITRUS | fraud.alert@citruspay.com |

| support@citruspay.com | |

| contact@citruspay.com | |

| nodalofficer@citruspay.com | |

| FREE CHARGE | risk.team@freecharge.com |

| care @freecharge.in | |

| riskteam @freecharge.in | |

| pga@klickpay.in | |

| BANK OF INDIA (digipurse | digipursecare@unionbankofindia.com |

| SPICESAFAR.COM | b2c.support @spicedigital.in |

| reco.safar@spicedigital.in | |

| vikas.kumar @spicedigital.in | |

| helpdesk@spicesafar.com | |

| FLIPKART.COM | murthy.sn@flipkart.com |

| OLX | support@olx.com |

| HDFC-PayZaap chillr | bohdfchyd@hdfcbank.com |

| PHONE PE | fraud@phonepe.com.cybercell@phonepe.com |

| BILL DESK | genius@billdesk.com |

| UBER | alert@uber.com |

| BHARAT MATRIMONY | Nodal officer-legal@consim.com |

| EBAY | Krishna mohan-kchaudhary@ebay.com |

| RECHARGEITNOW | Ganesh-ganesh.garg@rechargeitnow.com |

| Sharat-sharat.jain@rechargeitnow.com | |

| MOBIKWIK | risk@mobikwik.com |

| MOBILESS.IN | info@mobiless.in |

| help.mobiless@gmail.com | |

| info@hitachi-payments.com | |

| AMAZON | police-inquiries@amazon.in |

| BILL DESK | genius@billdesk.com |

| pgsupport@billdesk.com | |

| TTSL WALLET tata MMPL mobi wallet | rohit.gupta@ mrupee.in |

| payment system Itd | care@mrupee.in |

| nodalofficer@mrupee.in | |

| WAY2SMS | Rajasekhar-support@way2online.com |

| QATAR AIRWAY | callcenter@in.qatarairways.com |

BANK |

|

| ANDHRA BANK | frmg@andhrabank.co.in |

| AXIS BANK | statutory.notice@axisbank.com |

| BANK OF BARODA | gm.ops.ho@bankofbaroda.com |

| HDFC BANK | SomaSekhar.RaoDaduwai@hdfcbank.com |

| HSBC BANK | nodalofficerinm@hsbc.co.in |

| ICICI BANK | rangachary.kv@icicibank.com |

| ING VYSYA BANK | nodalofficer@ingvysyabank.com |

| DBS BANK | digitalbankIN@dbs.com |

| 1OB | creditcard@iobnet.co.in |

| KOTAK | escalations@kotak.com |

| KOTAK | service.bank@kotak.com |

| PNB | skbansal@pnb.co.in |

| PNB | vsrinivasan@ pnb.co.in |

| SBI | agmvig.Ihohyd@sbi.co.in |

| agmvig.lhoand@sbi.co.in | |

| call on 1800111109 |

The above mentioned contacts are provided from various websites and data collected from different persons. USE THESE CONTACTS AT YOUR OWN RISK. The author / website is not responsible in use of above contacts.

Please comment below with your suggestions, queries if any.